U.S. Regional Brief

This Regional Brief reports on the corporate governance topics and trends Vanguard’s Investment Stewardship team observed across portfolio companies domiciled in the U.S.; it includes data on the proxy votes cast by the Vanguard-advised funds between July 1, 2024, and June 30, 2025 (the 2025 proxy year). [1] We provide this brief, and other publications and reports, to give Vanguard fund investors and other interested parties an understanding of the engagement and proxy voting activities we conduct on behalf of the funds.

Vanguard’s Investment Stewardship team’s analysis of portfolio companies’ corporate governance practices centers on four pillars of good corporate governance, which are used to organize this brief: board composition and effectiveness, board oversight of strategy and risk, executive pay, and shareholder rights.

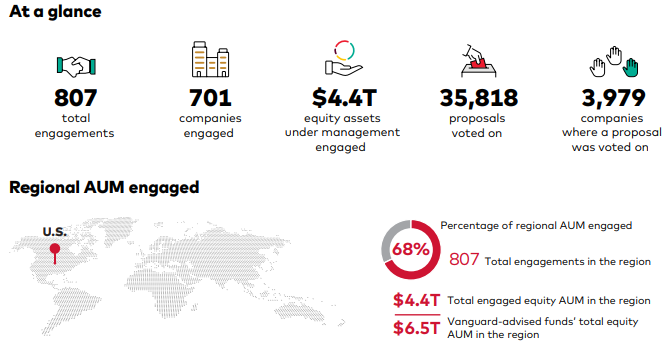

During the 2025 proxy year, the team conducted 807 engagements related to 701 companies in the U.S., representing $4.4 trillion in equity assets under management (AUM) of the $6.5 trillion in Vanguard-advised funds’ total equity AUM in the region. The funds voted on 35,818 proposals across 3,979 companies in the region.

Board composition and effectiveness

Good governance begins with a company’s board of directors. We seek to understand to what extent board members, who are elected to represent the interests of all shareholders, are suitably independent, capable, and experienced to carry out their duties. We also aim to understand how boards assess and enhance their own effectiveness over time.

During the 2025 proxy year in the U.S., we engaged with portfolio company directors and executives on a broad range of topics, including the assessment of boards’ evolving skill sets, disclosure of board composition and refreshment practices, and CEO and executive succession planning. We observed that many portfolio companies evolved their disclosures regarding board composition, with particular emphasis on board skills and refreshment, amid increased attention to skills in technology, public policy, and global trade.

Board composition disclosures

Among U.S. portfolio companies, we observed a continued trend toward enhanced disclosures related to the board’s evaluation of director skill sets and how company strategy informs the board’s assessment of the aggregate set of expertise and experiences most important to have represented in the boardroom. 2025 represented a notable shift in how corporate boards disclosed demographic information in their proxy statements, reflecting broader regulatory, legal, and political changes. After Nasdaq’s board diversity rules were vacated in December 2024, we observed that many companies’ proxy disclosure of director demographic information changed significantly. Instead of disclosing board diversity statistics in a standardized matrix (as had been required by Nasdaq’s board diversity rules), we observed that many companies scaled back or eliminated board diversity disclosures in their 2025 proxy statements. On behalf of the funds, we look for boards to be fit for purpose by reflecting sufficient breadth of skills, experience, perspectives, and personal characteristics, resulting in cognitive diversity that enables effective, independent oversight on behalf of all shareholders. We believe that the appropriate mix of skills, experience, perspectives, and personal characteristics is unique to each board. While we are not prescriptive regarding the form and particularity of a company’s disclosures, we look for boards to clearly disclose information regarding their composition so that shareholders can understand the board’s unique mix of skills and experiences that enables it to effectively oversee company strategy and material risks to long-term shareholder returns. We continued to engage on the topic of board composition throughout the 2025 proxy year.

CEO and executive succession planning

CEO succession planning is widely considered one of the most critical responsibilities of a corporate board. During our 2025 proxy year engagements with portfolio companies, many board members shared their approach to CEO and executive succession planning. Given its importance, we heard from board members about how boards are not waiting for a crisis to address succession. Many discussed how succession planning is a continuous strategic process that has been integrated into regular board agendas and long-term planning. Directors considered CEO and executive succession planning, as well as broader human capital management, as companies developed talent pipelines. Many companies described a shift in focus from identifying a single potential CEO successor to developing multiple internal candidates and encouraging cross-functional leadership development to prepare potential successors and future leaders. Boards also reported continuing formal emergency succession plans and conducting scenario planning to prepare for unexpected CEO departures. In our engagements, we also heard from some boards placing greater emphasis on ensuring that successors are an appropriate cultural fit with the organization, while also matching leadership capabilities with the organization’s future strategic direction.

Notable case studies |

| At the 2025 annual meeting of Phillips 66, a diversified energy company, the funds, following a thorough analysis, did not support an activist investor’s board nominees in a proxy contest. In our analysis of the activist’s case for change, we found that the company’s performance had lagged some of its peers over the longer term. Though we noted that company performance had improved following the appointment of a new CEO in 2022, we determined that the company should be given time to execute on its strategic initiatives. In our assessment, there were no demonstrable gaps in the company’s governance practices. Although the Phillips 66 board maintained a classified board structure, the company had proactively sought shareholder approval to declassify the board multiple times since becoming a standalone public company. In addition, we were unable to determine whether the election of the dissident nominees offered the board a differentiated set of skills compared with the company’s nominees. Ultimately, the funds did not support the election of the dissident director nominees, as we assessed that supporting the board-nominated directors was in the long-term best interests of the funds.

At the 2025 annual meeting of Netflix, Inc. (Netflix), an entertainment company offering paid subscriptions for streaming services, the funds did not support the reelection of the lead independent director due to insufficient attendance at board and committee meetings. Notably, the board did not disclose a reason for the director’s absences. Separately, we identified potential concerns related to the number of public directorship positions (sometimes referred to as “overboarding”) held by another Netflix director. As articulated in the funds’ proxy voting policy, we evaluate director capacity and commitments case by case, taking into consideration the facts and circumstances at the company in question. Directors’ responsibilities are complex and time-consuming. Therefore, we seek to understand how directors ensure sufficient capacity for board responsibilities. We look for clear disclosure of individual director commitments, board policies, and oversight of director commitments. Ultimately, the funds supported this director’s election at the 2025 annual meeting, as we assessed that the director’s commitments were reasonable, especially considering a recent change in responsibilities in another role. |

Board oversight of strategy and risk

Boards should be meaningfully involved in the formation, evolution, and ongoing oversight of a company’s strategy. Similarly, boards should have ongoing oversight of material risks to their company and should establish plans to mitigate those risks. We work to understand how boards of directors are involved in strategy formation and evolution; oversee company strategy; and identify, govern, and disclose material risks to shareholders’ long-term returns.

During the 2025 proxy year, we engaged with portfolio company directors and executives to better understand how their boards were identifying, disclosing, and mitigating material risks. While material risks varied by company, we found that many boards paid particular attention to emerging risks such as AI, cybersecurity, the evolving regulatory environment, and the effects of tariffs on global trade. While company leaders stated that many shareholders continued to express interest in how boards managed material risks and considered shareholder rights, we observed a notable shift in the number and types of shareholder proposals going to a shareholder vote. During the 2025 proxy year, we evaluated 576 shareholder proposals on behalf of the funds that requested actions from U.S. portfolio companies, down from 691 shareholder proposals during the 2024 proxy year.

Environmental and social shareholder proposals

During the 2025 proxy year, on behalf of the funds we evaluated 261 shareholder proposals requesting action from U.S. portfolio companies on a range of environmental and social matters, down from 400 such proposals during the 2024 proxy year. We observed various factors that appeared to affect the volume of shareholder proposals going to a vote in 2025. Among these factors were certain proponents increasing or decreasing their submission of proposals, an ongoing evolution in the SEC’s granting of no-action relief for companies to exclude proposals from the ballot, and voluntary withdrawal of proposals by proponents, often following reported engagement with the company. As a result, in the 2025 proxy year, we witnessed many companies that had previously received a significant number of shareholder proposals seeing a sizable decrease in that number. Another trend that continued into the 2025 proxy year was the increase in proposals that sought to reverse or rebuke a company’s approaches to climate change risks, sustainability, or a range of social issues.

The number of environmental-related shareholder proposals voted on by the funds decreased from the prior proxy year (82 proposals during the 2025 period, compared with 107 during the 2024 period). Proposals focused on climate risk and emissions disclosures were the most common environmental proposals during the 2025 proxy year. These proposals typically requested that companies disclose their greenhouse gas (GHG) emissions, climate-related financial risks, and strategies for achieving net-zero targets. New proposals included those that addressed risks related to potential climate-driven insurance impacts, deep-sea mining concerns, broader biodiversity loss, and supply-chain sustainability.

Across all sectors, companies received shareholder proposals focused on social topics such as diversity, equity, and inclusion (DEI); human rights and labor practices; and political contributions and lobbying disclosures. The consumer goods sectors continued to draw the largest proportion of social proposals. In the technology sector, we continued to see proposals related to disclosure and governance around AI use, and in health care, we saw a small but notable number of proposals involving reproductive rights and health care access.

Following our case-by-case application of the funds’ proxy voting policy, the funds did not support any environmental or social-related proposals at U.S. portfolio companies during the 2025 proxy year. The funds’ lack of support for these proposals is an outcome of our case-by-case analysis of each proposal in the context of the facts and circumstances at each company. In general, we noted that in many cases, these proposals did not address financially material risks to shareholders at the companies in question or were overly prescriptive in their requests—including, for example, proposals calling for specific GHG emissions targets. In other instances, we did not identify a gap in the given company’s practices or disclosures that the proposal would address.

Trends in workforce DEI

U.S. public companies made notable adjustments to their DEI programs and disclosures, largely in response to political, legal, and regulatory shifts. We noted that many company disclosures became data-driven and compliance-focused, often emphasizing voluntary initiatives rather than mandated targets.

Throughout the 2025 proxy year, we saw a number of shareholder proposals related to workforce DEI. Variations of the proposals included requests to adopt a policy to disclose EEO-1 workforce demographic data, abolish DEI goals in compensation plans and policies, report on discrimination risks of affirmative action initiatives, and report on the effectiveness of DEI efforts. Many of these proposals were directed at consumer goods companies, with additional concentrations in the financial, health care, and industrials sectors. In several cases, companies receiving a proposal requesting additional disclosure pointed to detailed disclosure of workforce data in their existing reporting.

AI risks and opportunities

Board oversight of new technologies, including AI, was a frequent topic of discussion in our engagements. Boards recognized the transformative potential of AI to enhance operational efficiency, customer experience, and long-term returns. Across a variety of sectors, we noted varying levels of adoption and integration of AI into business strategies, along with wide variation in the disclosure of risks related to AI and board oversight of such risks. Companies that incorporated AI into their strategies disclosed numerous reputational risk factors, including rollouts that were too fast or too slow, failure to meet customer needs or expectations, misuse of intellectual property by third-party vendors, and amplified negative reputational impacts driven by social media. Given these risks, along with the rapidly evolving regulatory and legal landscape, we noted that many companies remained cautious about overstating the financial benefits of AI to shareholders at this stage.

Though not consistently articulated by companies, in our assessment, disclosure of management and board oversight of AI strategy and risk continued to develop. More robust disclosures highlighted the role of leaders at all levels, the frequency of committee meetings, and disclosure of the risk-reporting hierarchy from board committees to the full board.

Notable case studies |

| At the 2024 annual meeting of Microsoft Corporation (Microsoft), a technology company that develops and supports software, services, devices, and solutions for consumers, the Vanguard-advised funds did not support a shareholder proposal requesting a report on AI data sourcing accountability. While the company disclosed that development and use of AI is a material risk, Microsoft’s public disclosures provided details on the company’s approach to sourcing data and user information for building generative AI models, including how those models are trained. Through our engagement, we assessed that the board had sufficient oversight of the risk and gained additional insights into how the management team was working to implement updates to reporting in response to the EU Artificial Intelligence Act, which took effect in 2025. Given the rapidly evolving technological and regulatory landscape related to AI, we ascertained that the company’s current and planned enhanced disclosures rendered the proposal duplicative of the company’s existing efforts.

At the 2025 special meeting of Enterprise Bancorp, Inc., a New England-based bank, the funds voted in support of a merger agreement with Independent Bank Corporation, another regional bank in New England. In recent years, we have observed an increase in transaction activity among U.S. regional banks. When evaluating mergers and acquisitions, we assess whether we believe it is likely that a given transaction will create long-term returns for shareholders. We use a governance-centric lens to analyze a deal’s impact on shareholder returns, focusing on four key areas: valuation, rationale, board oversight of the process, and the governance profile of the combined entity. In reviewing the merger in question, we noted that the board conducted a robust solicitation process and deployed a strategic transaction committee to oversee the deal. We did not identify concerns with valuation, and company disclosures indicated several strategic reasons why the merger was in the best interests of shareholders, including increased scale and improved access to capital. In addition, the surviving entity was expected to offer shareholders an improved governance profile. For these reasons, we determined that the merger was in shareholders’ long-term financial interests, and the funds voted in support of the transaction. |

Executive pay

Sound pay policies and practices linked to long-term relative company performance can drive long-term shareholder returns. We look for companies to provide clear disclosure about their compensation policies and practices, the board’s oversight of these matters, and how the policies and practices are aligned with shareholders’ long-term returns.

During the 2025 proxy year, we engaged with companies that were proactively soliciting feedback on their executive pay plans as part of broader discussions on corporate governance practices. We also prioritized engagements with companies where we identified potential concerns about the linkage between relative executive pay outcomes and long-term shareholder returns.

Retention equity grants

Equity compensation awards were a critical retention tool for many companies as they sought to retain employees in highly competitive industries, such as technology, biotech, and pharmaceuticals.

We observed that companies focused on developing AI routinely found themselves in intense competition for top-tier talent. During our engagements with companies, we regularly heard that AI, machine learning, and cybersecurity roles were among the hardest to fill and retain. The rapid evolution of AI technologies and their central role in innovation made experienced AI professionals highly sought after across a variety of industries. We heard from many portfolio companies that they were prioritizing retaining existing AI talent over acquiring new hires, as onboarding and ramp-up times for roles in AI can be long and costly. Companies leaned heavily on equity-based compensation to align long-term incentives with company performance. One-time equity awards were increasingly used to reengage employees and prevent attrition to competitors or startups. We saw some firms start to tie the vesting of such awards to innovation milestones or AI product delivery, reinforcing alignment with companies’ strategic goals.

We also saw many biotech and pharmaceutical companies that experienced major stock price surges during the pandemic make adjustments to their compensation programs to retain talent after stock prices declined. Compensation committees relayed that many of these changes were driven by the need to maintain morale, prevent attrition, and realign incentives in a post-pandemic market environment. Many companies either moved away from, or were considering moving away from, compensation programs that lean heavily on stock option-based equity, which some compensation committees have stated had become less effective as a retention tool due to underwater options. Many of these companies reported that they had considered increasing the use of full-value equity awards, which continue to hold value even when stock prices fall. Many companies relayed that this shift was aimed at preserving retention value for employees who may have lost confidence in the wealth-building potential of their equity awards.

We noted that opportunities existed for companies to provide enhanced contextual disclosure of their boards’ decision-making process and rationale in instances where they chose to issue retention equity grants. In engagements with portfolio company leaders, we continued to encourage companies to provide clarity on the discrete facts and circumstances underlying their decisions to make one-time awards.

Stock option repricing and exchanges

We believe that executive pay practices linked to long-term relative company performance are fundamental drivers of sustainable, long-term shareholder returns. As discussed in the prior section, many companies recently issued new equity retention awards to supplement or replace equity-based compensation that had lost motivational value. However, other firms explored repricing or exchanging underwater options for new full-value awards or options with lower strike prices.

Because we look for executive pay to ultimately align with company performance, we believe companies should ensure that repricing does not undermine the alignment between executive pay and shareholder interests. Stock options are intended to incentivize performance, and repricing can dilute that incentive. During the 2025 proxy year, the funds reviewed 11 requests to reprice or replace underwater options. In our analysis of these proposals, we took into consideration whether the proposal was part of a broad-based plan that included non-executive employees, as well as the rationale for such a move, such as a significant market-wide downturn.

Notable case studies |

| At the 2025 annual meeting of The Hackett Group, Inc. (Hackett), a strategic and digital transformation consulting firm, the funds supported an advisory vote on executive compensation (“Say on Pay”). Our review of Hackett’s executive compensation practices began with an evaluation of the company’s short- and long-term incentive plans, which showed an alignment between executive compensation and company stock performance. We also reviewed one-time grants awarded to senior leaders, which raised initial questions about the grants’ rationale, structure, and size. The company’s proxy statement provided detailed disclosures explaining that the grants were designed to retain key talent during a strategic transition involving a merger. The proxy statement detailed that the grants were structured to support long-term stock performance over a three-year period, and to offset their impact, the Compensation Committee reduced annual equity awards by 50% for the same duration. Based on these disclosures, we assessed the one-time grants to be reasonable. For more information on how the funds voted at Hackett’s annual meeting, see our Insights piece.

At the 2025 annual meeting of Pfizer Inc. (Pfizer), which develops, manufactures, markets, distributes, and sells biopharmaceutical products, the funds supported the Say on Pay proposal. In 2024, Pfizer significantly amended its outstanding equity awards as part of a strategic effort to retain key employees following the COVID-19 pandemic and a challenging stock performance environment. The offer allowed eligible participants to modify certain performance-based equity awards into revised awards with terms better aligned to the company’s long-term performance goals and current market conditions. These modifications were designed to enhance the retention of key talent during a period of strategic recovery and to reinforce alignment between employee incentives and shareholder value. Although we had initial concerns about the modification of the awards, we determined that the governance around the changes was reasonable and aligned with long-term shareholder returns. The nature of the modifications, the Compensation Committee’s explanation of the underlying rationale in company disclosures, and our engagements with Pfizer leaders helped us understand how the modifications and the Compensation Committee’s oversight aligned employee pay with long-term shareholder returns. At the 2025 annual meeting of Vertex Pharmaceuticals Incorporated (Vertex), a global biotechnology company, the funds did not support a shareholder proposal seeking the adoption of a policy requiring shareholder approval for executive severance agreements exceeding 2.99 times the executive’s base salary plus a target short-term bonus. On behalf of the funds, we evaluate all shareholder proposals case by case, taking into consideration the facts and circumstances at each company, and, as stewards of passively managed funds, we do not support shareholder proposals that in our judgment seek to influence or dictate company strategy. In our assessment, we found that Vertex’s existing severance agreements were reasonable and in line with market norms. For more information on how the funds voted at Vertex’s annual meeting, see our Insights piece. |

Shareholder rights

Shareholders have fundamental rights as company owners. We believe that a wellfunctioning capital markets system requires that companies have in place governance practices and structures that enable shareholders to exercise those rights.

Reincorporation proposals

In recent years, an increasing number of U.S. public companies have reconsidered their state of incorporation, with many seeking shareholder approval to effect such changes (often referred to as “redomestication”). States such as Nevada and Texas are competing more directly with Delaware—where more than 60% of companies in the S&P 500 Index were domiciled as of the end of 2024—by providing jurisdictions perceived to offer, among other things, a more business-friendly legal framework and reduced exposure to derivative lawsuits. Nonetheless, companies choosing Delaware frequently point to the state’s well-established body of corporate law, experienced judiciary, and predictable legal framework.

During the 2025 proxy year, we saw management proposals at 31 portfolio companies seeking to change their state of incorporation, compared with 21 in proxy year 2024. We evaluated these proposals case by case, taking into consideration the reasons for the reincorporation and the differences in regulatory, governance, shareholder rights, and any other potential benefits. As part of this process, we sought to understand the rationale for reincorporation, including whether the proposed jurisdiction offered governance protections that were consistent with or enhanced shareholder rights. We also evaluated whether reincorporation would limit shareholder recourse in cases of breaches of fiduciary duties or would otherwise entrench management. Further, we considered the company’s business connection to the state it was considering reincorporating to (such as the location of its headquarters or primary business line). In cases where the proposed jurisdiction provided comparable or improved governance standards, or where the company had demonstrated a compelling rationale, the funds generally supported such proposals. However, when we assessed that reincorporation would weaken shareholder protections or lacked a substantiated link to the company’s core business, or in cases where we assessed that the company did not disclose a compelling rationale, the funds voted against reincorporating. Based on our case-bycase analysis of each of these proposals in the 2025 proxy year, the funds supported approximately 57% of them.

Special meeting shareholder proposals

During the 2025 proxy season, we saw shareholder proposals at more than 60 portfolio companies requesting either the adoption or amendment of provisions enabling the company’s shareholders to call a special shareholder meeting. Many of these proposals sought to eliminate continuous ownership requirements for shareholders’ participation in the solicitation to call a special meeting.

We look for companies to adopt governance practices that help ensure that boards serve the interests of the shareholders they represent. We recognize that when it comes to the ability of shareholders to call a special meeting, excessive ownership thresholds and longer-term holding periods can be perceived as disenfranchising certain shareholders. However, we also recognize that such requirements can reduce frivolous shareholder meetings, thereby minimizing management distraction and avoiding significant expenses, while allowing company management the opportunity to engage with interested shareholders. The funds will vote case by case to assess the impact of an ownership threshold or holding period for the right to call a special meeting, taking into consideration whether the company already provides such a right and, if so, at what threshold. Following our case-by-case analysis of each of these proposals during the 2025 proxy year, the Vanguard-advised funds supported approximately 17% of them.

Notable case studies |

| At the 2025 shareholder meetings of several related issuers under the Dolan Family Group— which include Madison Square Garden Sports Corp. (MSGS), Madison Square Garden Entertainment Corp. (MSGE), AMC Networks Inc. (AMC), and Sphere Entertainment Co. (Sphere)—the funds voted on proposals at each company to redomesticate from Delaware to Nevada. While the funds did not support the proposals at MSGS, MSGE, and AMC due to what we assessed to be insufficiently compelling rationale relative to the associated diminishment of shareholder rights, the funds supported the proposal at Sphere. We assessed that the rationale presented at Sphere presented a more compelling case for alignment between the company’s operational footprint and its state of incorporation. Following the September 2023 opening of the Sphere music and entertainment arena in Las Vegas, the company disclosed that approximately 90% of its property, plant, and equipment; the majority of its revenues; and most of its employees were based in Nevada. Although the company is not headquartered in the state, this operational concentration provided a unique context that differentiated the redomestication proposal at Sphere from the proposals put forward at the other Dolan Family Group companies. While the arguments across the issuers—such as reduced litigation risk and increased governance predictability—were broadly similar, we gave substantial weight to the operational alignment in Sphere’s case. We determined that the benefits of the change, in this instance, outweighed the governance trade-offs.

At the 2025 annual meeting of Quest Diagnostics Incorporated (Quest), a laboratory testing and diagnostics company, the funds did not support a shareholder proposal to eliminate the share ownership period needed to call a special shareholder meeting. The company’s certificate of incorporation provided that a Quest shareholder or group of shareholders holding at least 15% of the company’s shares could call a special meeting, subject to a one-year continuous holding period. The proponent, seeking to eliminate the continuous holding period, stated concerns about disenfranchising shareholders in certain scenarios, especially in potential emergencies. While we recognized the potential benefits of active investment and the need for immediate action in specific, emergent scenarios, we did not consider a one-year holding period to be excessive. Further, in the event of an extreme governance failure, newer shareholders could voice their concerns at the company’s next annual meeting, which typically occurs within 13 months of the company’s prior annual meeting. |

Proxy voting data

The volume of proposals voted on in the U.S. during the 2025 proxy year decreased overall from the prior proxy year. Overall, we saw a decrease in the number of shareholder proposals, attributable to a decrease in proposals focused on environmental and social topics.

1Vanguard’s Investment Stewardship program is responsible for administering proxy voting and engagement activities pursuant to the Vanguard-Advised Funds Policy for the quantitative and index equity portfolios advised by Vanguard (together, “Vanguard-advised funds”). This publication describes the proxy voting and engagement activities conducted by Vanguard’s Investment Stewardship program pursuant to the Vanguard-Advised Funds Policy; it does not include (a) votes cast on behalf of investors who, through Vanguard’s Investor Choice program, chose to have their proportionate portfolio holdings in certain index funds voted in accordance with a policy other than the Vanguard-Advised Funds Policy, or (b) proxy voting and engagement activities for externally managed funds conducted by their respective third-party investment advisors. Throughout this document, “we” refers to Vanguard’s Investment Stewardship program and “the funds” refers to Vanguard-advised fund shares voted pursuant to the Vanguard-Advised Funds Policy.(go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.